Social Security is a Ponzi scheme that will ultimately fail. It is a terrible experiment that, the longer it goes on, the worse the financial catastrophe will ultimately be. We should be able to keep our money and invest it where it will do some good. Social Security is not secure and it destroys the social fabric of our society.

Social Security is a Ponzi scheme that will ultimately fail. It is a terrible experiment that, the longer it goes on, the worse the financial catastrophe will ultimately be. We should be able to keep our money and invest it where it will do some good. Social Security is not secure and it destroys the social fabric of our society.I see approximately $300 per month of my paycheck go some god-forsaken entity called FICA, and if I think too long about that acronym, it begins to look like a vulgarity. Not only does this FICA soak me for $300, but he gets the same amount out of my employer, only to deceive me into thinking he's taking only half as much as he really is. This means that under normal circumstances I would be making about $600 more per month on my paycheck.

If I were to invest this $600 per month for the 16 years that I have worked at this job at a conservative rate of 4% interest, I would have approximately $161,003. If, from now until I retire in the year 2030, I just let that money sit and continue to gain 4% interest, it will be worth $412,692. But if I continue to invest $600 per month during that time, I will have saved $709,177.

The 2006 average monthly benefit for a retired couple is $1,648. Let's say that by the time I retire, the amount my wife and I get from Mr. FICA is $3000 per month. If I live to be 100, we will have received $990,000.

Looks like we'll be getting a great deal! But wait... If I were to take the same $3000 per month from my personal account as it continued to earn the same 4%, it would take me til I was 106 years old to deplete my savings. More importantly, I could hold down another job if I wanted to and still collected my annuity from my personal savings account, which I cannot do if I want to collect $3000 from Social Security.

Social Security does not earn interest, at least not for me. Besides that, it is a pipe dream to imagine that my wife and I will really receive $3000 per month from Mr. FICA when we retire. And what happens to my Social Security when I die? It's gone. But the savings in my personal account belong to my spouse and children.

I want my money back. No actually, let's do this. Stop making me pay Social Security taxes (and my employer on behalf of me) and let me invest that amount in a private account. I will make way more than 4% doing that, by the way. And you know what? I would be glad to renounce all prior payments to Mr. FICA if I could make this change right now.

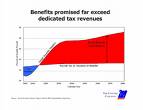

The problem is--the money I spend into Mr. FICA's account was never meant to socially secure me. It's meant to socially secure my parents and my grandparents. So who's going to secure me when I get that old? And then whose going to secure them? You start to get the picture. It's a corrupt Ponzi Scheme. The Social Security Trust fund is bankrupt now, but Mr. FICA doesn't tell you about that. Imagine the financial fallout that will obtain in the near future when it is determined that there are no more government money buckets to rob to pay for Social Security entitlement obligations.

Social Security takes away the responsibility of family members to take care of themselves and thus breaks down the family unit. In the past when grandparents had trouble, their children were more likely to take them in and help them pass the last few years of their lives. But with the advent of Social Security, they unfortunately let everyone else take care of them in most cases. Nowadays families don't stick together as much as they once did, and a major cause is the advent of Social Security.

It is far past time to phase out Social Security and let us take care of ourselves with our own money. Everyone will be better off.

Amen. I wish Congress had the willpower to act on Social Security.

ReplyDeleteYour points are well taken. However, as many of my liberal friends point out, the save-for-yourself paradigm does not address care of the poor and less fortunate, which many liberals tout as the moral basis for the SS program.

ReplyDeleteThey fear that shifting to a system that focuses mainly on earning ability will leave those unable to provide for themselves (or at the bottom end of the earnings scale) without any method of realistically meeting their needs later in life. They also suggest that an individualized system will lead to further class distiction, which they view as the hallmark of an immoral society. In other words, they kind of see the SS program as a sort of welfare system that all producers pay into for the good of the whole society.

I do not agree that having a big government program that exacts earnings from producers and applies it in a shotgun method constitutes a moral good. I believe there are better ways of doing that. I believe that the welfare element and the retirement investment elements of the program should be separated. Keeping them coupled makes little sense. The investment portion should work as you state. We would have to have a national debate about what the welfare portion should look like.

Cameron,

ReplyDeleteIf we could get Scott Bradley instead of Hatch and Jim Noorlander instead of Cannon, we'd be much closer to a solution.

Thanks for your comments.

Reach Upward,

You bring up some good points. It seems to me that the individual states should take care of such welfare, not the Federal Government. (Although our liberal friends will counterclaim that some states are richer than others.) There does need to be some sort of security net, but the way it stands, Social Security discourages the family in many cases of need from being the helper of first resort.

When I get some time, I hope to develop that concept (government discouragement of enterprise) in a post about why I think Minimum Wage Laws actually repress wages in general.

Stay tuned...

If everyone has been paying into this system since the beginning, why is it that our current payments pay previous depositors. What happened to all the money collected before? If everyone has to pay into it until 62, and has to have earned enough credit by paying in a certain amount, and married couples can only collect 1 even if they both had enough paid in, and when you die, what ever is left over stays in, where did all the left over Money go? This is a pyramid scheme which we are forced to be in.

ReplyDeleteGrossly corrupt!!!

And this plan is long in the running, I truly do not believe this is a mistake, I believe this was the plan from the beginning.

I wonder who is in charge of auditing S.S. themselves?

In nature, If something cannot support itself, it doesn't multiply

How many people who don't pay into S.S. and collect from the rest of our work are given the resources to grow anyways and multiply?

Feels disproportionate to me.

How nearsighted can you get? If you invest your money yourself, you will be taken advantage of by the shills of wall street. I have had a 401K account for two decades and I lost over twenty percent of the money I invested. There is no simple answer, as it takes more than one leg to hold up the stool of retirement. You Rocky Mountain thinkers are completely out of touch with the rest of the country. I need my Social Security check as well as my 401k and the modest industry pension I earned over the decades. I live in California on a low income, and if you had your way, people like me would starve or riot. You're supposed to be a Christian, aren't you? Ever hear of compassion? Or is that just a socialist/humanist concept?

ReplyDelete